Wholesale business Risks-Rewards

The decision to enter a business venture as an owner either on a control or minority interest ownership is a risk / reward decision. Predicting how all the variables will interact and change over the horizon can be complicated depending upon the expectations and level the uncertainties present.

If you as an investor will not tolerate the level risk and variations or uncertainty associated with the investment, I recommend you invest on a safe investment such as treasury bonds or the similar. If on the other hand, you want a higher return on your investments, you will have to tolerate the higher risk associated in pursuing it whether you are an active or passive investor.

Take for example if you enter a distribution business, importing from China:

Wholesale distribution is one of the oldest business models in history. From the earliest days of traders selling goods from faraway lands – brought to another country by ship or caravan – manufacturers of products have required the services of skilled sales professionals to get their goods to a willing market with money to spend. Wholesale distribution has taken place throughout history in many countries and cultures. In the U.S., wholesale distribution is a big industry, and most of the companies in the industry are small businesses, not large corporations. The distributors who make up the industry, however large or small, all follow a more-or-less uniform process in playing their part in getting goods to their end users. There are a few different variations in wholesale distribution regarding how the distributor passes on ownership of the goods they sell, and the way those goods wind up in the hands of the end user.

Wholesale distributors buy products and goods from their manufacturers, then sell those goods to retailers, who then sell them to the end user.

Wholesale Distribution and the Wholesale Process

The process of wholesale distribution fills a crucial function in modern retail commerce and manufacturing industries for both consumer and business markets. The businesses that create and produce goods for sale must rely on other businesses to move those goods into the stream of commerce, where the end purchasers can ultimately buy them for personal or business use.

Take the example of a Christmas-tree ornament maker. If this maker is an individual artisan crafting only a few hundred ornaments a year, the best distribution model will involve a direct approach to local retail and specialty stores. The stores purchase the ornaments, then sell them to individual purchasers who then display the ornaments on their Christmas trees. The individual purchasers in this scenario are the end users, and they buy directly from the retail establishment. This method may work well for the ornament maker at this small level of production.

Set your limits and expectations. Identify the key variables influencing the final outcome. The key to any business venture is to be able to have a set range of return-on-investment ratios, net present values, break even analyses, payback period, time and effort required, and equity investment capabilities. Perform the SWOT analysis (Strengths, Weaknesses, Threats and Opportunities. and then develop the future least or minimum probable, most probable, and highest or maximum probable scenarios, reducing the margin of error and uncertainties as much as possible of the business outcome. If it meets expectations, then you go for it.

The Supply Chain and pricing

- Identify the supply chain risks associated with the venture

- Price paid at point of origin

- Commissions paid at origin

- Freight, Transportation, and Insurance costs from point of origin to mid-point at west coast

- Freight and Transportation from mid-point of origin to Puerto Rico

- Transportation cost from Puerto Rico Pier to warehouse

- All associated warehouse costs including inventory tax during days of storage at warehouse

- Reduce the days on inventory and size of inventory.

- Establish a price that:

- Maintains your profit margin

- Are competitive in the marketplace

- Is acceptable to the buyer

- The buyer reprices building up his profit margin

- The end consumer accepts a price that does not affect demand

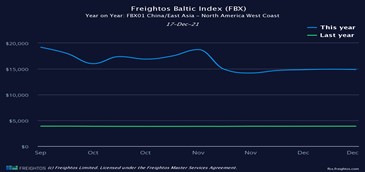

The graph shows that the shipping prices of containers from China to the United States (West Coast), have suffered an increase compared to the previous year.

Pricing Strategy

There is a pricing strategy at the various points of sale in the chain. Price resistance is measured to affect pricing without affecting demand (which in this case is elastic). Pricing can be worked from point of origin to the end consumer; or backwards, from the consumer to the point of origin, while theoretically always maintaining the profit margin established through the buy/sell process.

A market and feasibility study may be the tool to assist in a business planning scenario. Based on your expressed needs and wants, an appraisal study may not be the right tool. The valuation only measures the Fair Market Value of the business at the date of the appraisal for buy/sell purposes. Based on your own investment criteria and expectations you either “go” or “no go” into the investment.

As you may know, the supply chain has associated costs at various points of the chain. One thing is certain, it is not static and subject to market forces driven by supply and demand at each point in the chain. There is an extent to which pricing (and profit) may be critically influenced, being those the point of origin and end consumer.

End

D. Sorroche

MBA, BCA, CMEA, CDEI, MIE

College of Ethics, Standards and Best Practices

12/18/2021