OUR SERVICES

The purpose of any professional valuation is to provide an opinion of value that is complete, relevant, reliable and credible for the intended use of the appraisal report by its intended user(s). After defining the appraisal problem, the opinion of value is developed and communicated; following the guidance of Uniform Standards of Professional Appraisal Practice (USPAP), promulged by the Appraisal Standards Board of the Appraisal Foundation & Best Practices.

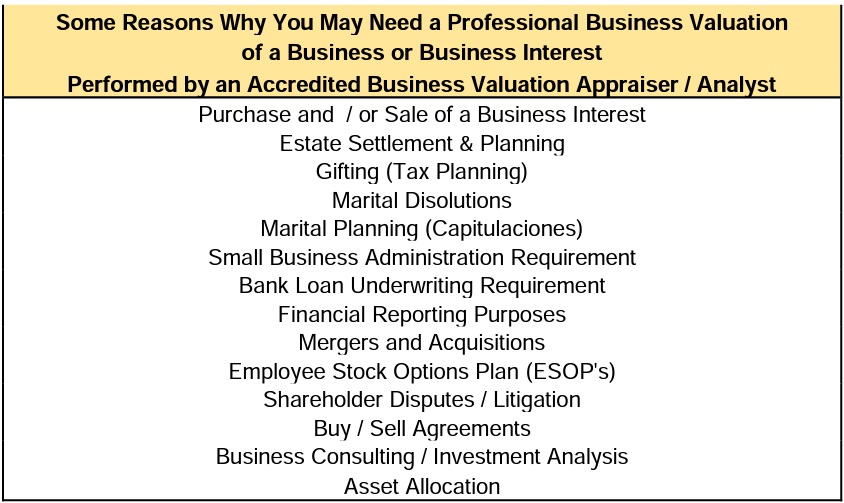

BUSINESS VALUATION

Business valuation professionals have come a long way since the IRS Revenue Ruling 59-60, considered the cornerstone of business valuation and particularly since the 80’s after many books have been authored by recognized experts and published and updated to serve as texts and reference in the field of business valuation. The courts and the IRS have become more knowledgeable on the subject. When valuing a business interest, we consider the form of ownership and whether it is the invested capital (debt and equity), or the equity participation.

* Businesses

* Business Interests

* Minority and Control Basis

Commonly valued interests

- Invested capital (debt and equity)

- Equity

- Controlling interests, as an example > 50%

Majority interest in a non-controlling formation, as an example 30%, 20%, 20% - Minority interest, as an example < 50%

- Minority interest in a controlling formation, as an example 2%, 49%, 49%

Commonly valued discounts

- Discount for lack of marketability (DLOM)

- Discount for lack of control (DLOC)

- Key person discount

Common Valuation Issues:

- Is it a valuation of shares or of assets?

- If of shares, Is it on a control or minority basis?

- Is there a buy / sell agreement?

- Is there personal or business goodwill?

- Is the valuation on a liquidation or going concern premise?

REAL ESTATE APPRAISALS

Real estate is considered to be land (which is fixed and unmovable) and improvements to the land (such as buildings), and fixtures (such as any permanently fixed item to the real estate; i,e elevators, air conditioning, chillers, boilers, bathroom fixtures; plumbing, electrical wiring, and the similar. Furniture and Equipment and movable objects are separately valued and not considered to be part of the real estate.

In its simplest term, an appraisal is the act or process of developing and communication an opinion of some type of value. The value provided in an appraisal is some measure of the relative economic worth of the asset, usually expressed in terms of cash or cash equivalent. In other words, the appraiser, based on education, experience and what is known to “the best appraisal practices” as of the date of the appraisal, quantifies to a certain level of precision (or in the opposite reduces to a certain level the uncertainty) associated with what typical buyers and sellers in the market place would consider to be the relative worth of the asset for exchange purposes, if the value sought is market value.

Real property includes the interests, benefits, and rights inherent in the ownership of real estate. In an appraisal, a particular set of real property interests, and not the property itself, is what is valued. Real property in itself has no value, The rights, or interests; i.e., “bundle of rights” in the real estate is what has economic value. Real estate is considered to be immobile and tangible.

We at Puerto Rico Appraisers & ConsultantsTM have Licensed and Certified General appraisers. All our appraisals are prepared in conformity with the Uniform Standards of Professional Appraisal Practice (USPAP), and in particular with Standards 1 & 2 applicable to real estate property.

o Vacant Land

o Residential

o Commercial

o Industrial

o Special Purpose Properties

PERSONAL PROPERTY (M & E) APPRAISALS

As we have expressed, appraisal is the act or process of developing and communicating an opinion of value. Because the Personal Property (M & E) Appraiser deals with a variety of assets, most which can be moved (contrary to for example real estate land), it is necessary to recognize different premises of value; i.e. Sales Comparison, Cost, and Income.

The standard of value is then modified by the premise of value. For example, Fair Market Value – Removed; Fair Market Value “as-is”, where-is”; Fair market Value –Installed; Fair Market Value – in Continued Use. These premises or modifiers can broadly be classified into three categories, distinguished by the asset anticipated use.

- Sale for removal for a similar or alternate use

- Continued (or installed) use of the asset for the purpose of which it was designed or acquired.

- Liquidation

- Salvage, or scrap value

We at Puerto Rico Appraisers & ConsultantsTM have Certified Personal Property (M & E) appraisers. All our appraisals are prepared in conformity with the Uniform Standards of Professional Appraisal Practice (USPAP), and in particular with Standards 7 & 8 applicable to personal property.

We stand ready to assist you in the valuation of your personal property including Machinery, Furniture, Fixtures, Equipment, Artwork, and the similar.

Please remember that as professional appraisers, licensed and certified, contrary to brokers and sellers, we must be independent, objective, and unbiased and our appraisal reports must be complete, relevant, reliable, and credible.

* Equipment

* Machinery

* Art Work

* Household Contents

LEGAL SUPPORT - EXPERT WITNESS/CONSULTING

Our Legal Support Includes:

- Consultancy and Litigation Support

- Eminent Domain / Compulsory Expropriation

- Appraisal Review